Trading Binary Options With Price Action And Heikanashi Candles

The Heiken Ashi binary options strategy involves the utilize of the Heiken Ashi candlestick indicator, equally well equally, the MACD indicator.

In this case, we shall be deploying a custom-fabricated MACD indicator, which has been colour-coded to recognize trend changes much before than the conventional MACD indicator which comes with the forex charts.

Indicators required for this strategy

The indicators to be used for this strategy are:

- The Heiken Ashi indicator: This is a custom-made indicator which plots Heiken-Ashi candlesticks on the asset charts.

- The MACD color-coded histogram: This is some other custom-made indicator which paints the MACD histogram component of this indicator blue or carmine according to trend bias.

- 21-day EMA: Interim as back up or resistance for the price action depending on where price action is going.

- 7-day EMA: While this indicator is non a very integral office of this strategy, the vii-solar day EMA can be used as an additional indicator to the chart to notice tendency when this is not ascertainable on the charts at commencement glance. (Acquire more about Moving Averages and how to use them)

The Heiken Ashi indicator will plot candlesticks using the following data:

- open and closing price information from the previous time flow

- open price, high price, low price and closing price data from the electric current time menses

The Heiken Ashi candlesticks are therefore different from the conventional candlesticks and on a nautical chart, these volition be seen plotted as additional candles on pinnacle of the Japanese candles. For this demonstration, we have adjusted the colours of the Heiken Ashi candles to blue and red respectively; blue candles representing up candles and red candles representing down candles.

The strategy

The Heiken Ashi candlesticks indicate when the trader should trade Call or Put based on color changes. And so when the Heiken Ashi candles plough red in color, information technology is a bespeak to prepare for a PUT entry, and when they plough bluish, it is a point to set up for a CALL entry. These colors can be customized past the trader for visual clarity.

The 21-day exponential moving average (EMA) is the resistance-support line for this trade, while the MACD histogram also determines the trade direction by means of a color modify. Cherry is a signal to PUT, and blue is the bespeak to Phone call. A typical merchandise performed with this strategy must therefore have all these parameters into consideration and put them together then that signals are make clean, articulate and unambiguous.

Telephone call Trade

The Call trade setup occurs when the following weather occur at the same time:

- The Heiken Ashi indicator candles are blue.

- The price bounces off the 21 EMA

- The MACD histogram bars are blueish in colour.

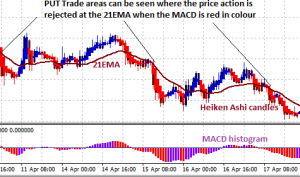

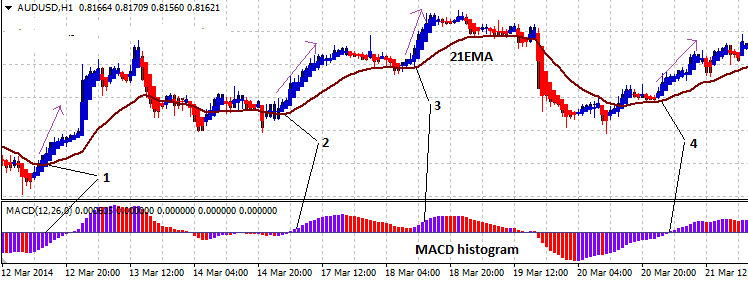

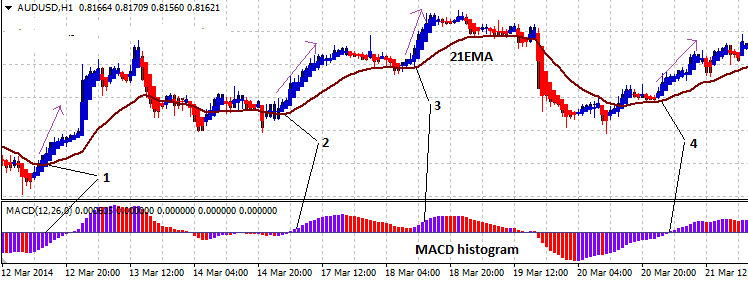

These conditions are displayed in the chart that nosotros accept shown beneath:

This is a one hr nautical chart that displays the fact that there are several opportunities to trade this setup over a one-week menses. Nosotros can see that on this chart, four areas to set up a Call trade (marked 1, ii, 3 and 4) were seen over a 9-mean solar day period. When the market is trending, the opportunity to profit from this trade is enhanced.

Every bit in like trade setups we accept described, it is necessary to determine the correct go out bespeak for the trade so that the expiry fourth dimension will leave the merchandise in the money. While left to the trader's discretion, it is suggested that the trader can go out an expiry time of about 4 hours, or four candles in length for a trade taken from a one-hr nautical chart.

PUT TRADE

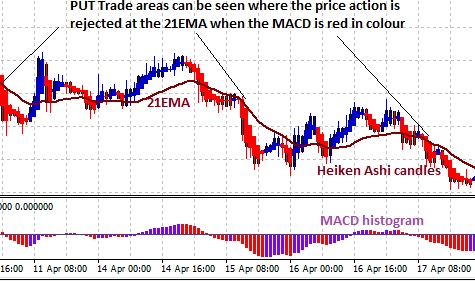

The trader should curt the currency pair when the iii indicators show the following characteristics. Once more, these should all be seen at the same time:

- The Heiken Ashi indicator candle confined assumes a red colour.

- The cost action has come from above and cleaved the 21 EMA to the downside, or is coming from below in a pullback fashion and is rejected at the 21 EMA.

- The MACD histogram confined are already cerise in colour.

The chart below shows the possible entry points for a long merchandise based on the conditions that we have stipulated above on a daily chart.

The snapshot displays the setup that occurs that makes a PUT trade possible. The lines indicate where price action marked by red Heiken Ashi lines bounce off the 21EMA line and provide the trade signals. Once once more, information technology is pertinent to set the death time using the timeframe chart every bit the guide. This chart was pulled from a 1 60 minutes nautical chart, and therefore it would be ok to utilize at least four candles as the length of fourth dimension which should be allowed to pass before the trade expires.

Tips for better trades

A closer examination of the charts will show that there are times when the Kumo will exist horizontal in orientation, showing that the price activeness is going to be in consolidation or will exist in a range-leap mode. This strategy works all-time when the Kumo is in a tendency, showing that the asset will exist in a trending mode. A trending market will not be in the best involvement of the trader as the asst has to make a move in some direction to actually give the chosen trade a chance at success. Then how tin the trader ostend that the market will trend?

1 fashion of performing a confirmation to see if the price action is actually going to trend is to introduce another indicator. One such indicator which is used to notice a tendency is the five-day exponential moving average (v EMA). When the 5 EMA crosses over the 21 EMA in ane direction, it is about likely that this will exist the management of the trend. Where the v EMA fails to produce a definitive cross with the 21 EMA, the marketplace volition in all probability terminate up beingness range-bound and the strategy will non deliver. Then perhaps the trader will demand to add together the 5EMA to the chart to cheque for the trend before executing any kind of strategy.

Ane of the best indicators based on MAs is tendency indicator for MetaTrader 4 that not merely produces non-repainting crossover trading signals, but too filters them through ADX, which measures the forcefulness of a trend.

Delight recollect to test all your strategies on a demo account first.

Trading Binary Options With Price Action And Heikanashi Candles,

Source: https://winatbinaryoptions.com/heiken-ashi-binary-options-strategy/

Posted by: stmartinprockleart.blogspot.com

0 Response to "Trading Binary Options With Price Action And Heikanashi Candles"

Post a Comment